We changed the credit tier from “good” to “poor,” as reported to the insurer, to see rates for homeowners with poor credit. If you have a mortgage on your home, your lender will probably require you to buy homeowners insurance. If you don’t have a mortgage, whether you get homeowners insurance is likely up to you. However, unless you could afford to rebuild your home after a disaster, buying a homeowners policy is generally a wise decision. Texas homeowners can also sign up for complimentary Wildfire Defense Services.

How to save money on your homeowners insurance in Texas

When comparing rates for different coverage amounts and backgrounds, we change only one variable at a time, so you can easily see how each factor affects pricing. “To support our growth, we have hired two senior industry executives with proven track records and extensive expertise in the insurance sector to advise Janover Insurance. We have also hired a full-time manager from one of the top firms in the world to run the business.

How to save on home insurance policy renewals in Texas

DiscountsRatings are based on the number of discounts a company offers in comparison to other insurers. Our partners cannot pay us to guarantee favorable reviews of their products or services. A rash of failures of A-rated insurers points to a hidden weakness in the market, researchers say.

Don’t sleep on this deal: a $14 one-year Sam’s Club membership with auto-renew

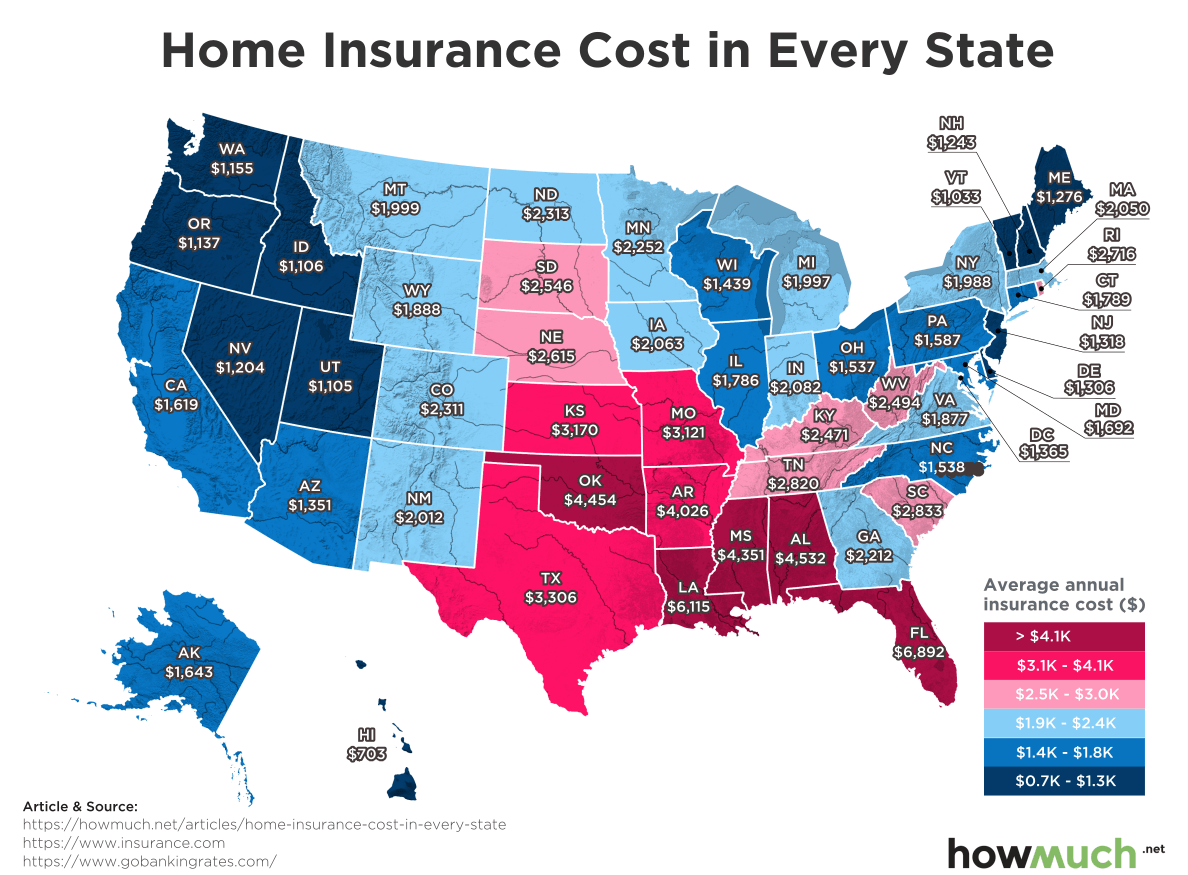

Cities with a high risk of natural disasters such flooding or extreme weather conditions will likely have higher average home insurance rates. The average cost of homeowners insurance in Texas is $2,919 per year for an insurance policy with $300,000 in dwelling coverage. We looked at average costs, customer service ratings, and policy options from multiple top insurers to find the best and cheapest home insurance companies in Texas. Texans pay so much more than Californians thanks in part to our business-friendly regulatory environment.

Bankrate Scores

If your neighborhood has seen many claims over the past few years, you can expect to pay higher home insurance rates than an area with few to no claims. Your credit score can also play a role in determining your home insurance costs. Tornadoes, thunderstorms, and hail can unexpectedly cause property damage in the spring, while hurricanes and flooding hit in the fall. Liberty Mutual understands the needs of Texas homeowners and offers customized homeowners insurance coverage to fit your specific situation. The average cost of home insurance in Texas is $5,180 a year for a home with a dwelling coverage of $400,000.

Texas approves 36 double-digit homeowners insurance rate hikes in Q3'23 - S&P Global

Texas approves 36 double-digit homeowners insurance rate hikes in Q3'23.

Posted: Tue, 31 Oct 2023 07:00:00 GMT [source]

Tips for Buying Homeowners Insurance in Texas

He is passionate about weather and the outdoors and often spends his days off on the water fishing. Keith McMasters who lives in the area also shared photos of damage to his property with KPRC 2. TRINITY COUNTY, Texas – A severe weather system moving through SE Texas on Sunday evening spawned an EF-1 tornado that destroyed one home and damaged others.

How we make money

What we didn’t anticipate, when the sellers accepted our bid, was a home insurance market that has gone crazy. Tell us your zip code and we'll suggest coverage options that may be a good fit for where you live in Texas. If your home insurance company cancels your policy or doesn’t renew it, you can ask for an explanation why. When it comes to nonrenewal, insurers typically have a legally mandated time frame in which they need to let you know. Average rates for homeowners insurance in Texas were calculated using data from Quadrant Information Services.

To provide a clearer picture of these disparities, we've provided a map and a searchable data table below. By exploring this information, homeowners can get a better understanding of insurance costs across different Texas cities. There's no one "best" home insurance company in Texas — it will vary depending on your coverage needs, where you live, and your priorities when it comes to cost, customer service, and claims. That's why the easiest way to find the "best" home insurance company for you is to compare quotes from multiple companies. In many areas of Texas prone to tornadoes or hurricanes, many insurance policies have a wind and hail exclusion, meaning insurers won’t cover repairs to property damaged by wind or hail. Home insurance costs in Texas can vary substantially depending on where you live.

In the case of a total loss, Chubb’s cash settlement option gives homeowners the choice of whether or not to rebuild their homes. Chubb’s unique coverage offerings make it an ideal option for homeowners who want flexibility in their policies. In case of a total loss, Chubb’s cash settlement gives homeowners the choice of whether not to rebuild their homes. Policyholders may also utilize the services of highly-trained risk consultants to ensure that their homes are adequately protected. The best homeowners insurance in Texas is with Chubb, which earned impressive affordability and financial stability scores.

Amica scored the highest on customer satisfaction and second highest in financial stability. Its policies cost an average of $4,273 per year, and it offers coverage for earthquakes. Buying a house is typically one of the biggest purchases you will ever make, so it is essential to protect your home with an insurance policy. MoneyGeek scored insurers based on customer satisfaction, affordability, claims reputation and financial stability. Here is the average annual cost of home insurance in Texas for dwelling coverage levels of $200,000 to $600,000 with a $1,000 deductible and liability coverage of $100,000 and $300,000. Chubb is known for its premium insurance offerings, particularly for homeowners who are seeking high-value home insurance policies.

And while the price is an important consideration, Bankrate knows there's more to a home insurance policy than just the cost. Our insurance editorial team, which includes licensed and experienced agents, conducted extensive research into the Texas home insurance market. One of its standard policy coverages is contents replacement cost coverage. This pays for the cost of replacing your personal property if it is damaged or destroyed by a covered loss, and it doesn’t factor in depreciation. USAA also offers significant discounts for bundling home and car insurance policies and for being claims-free for a minimum of five years.

No comments:

Post a Comment